How To Kickstart Your Peer Lending Journey: Everything You Need To Know

As the P2P lending industry grows in Nigeria,...

March 31, 2024

Have you ever wondered how your savings could grow over time without additional work from you? That’s the magic of compound interest, often referred to as the eighth wonder of the world.

It’s not just a concept for the financially savvy; understanding compound interest is crucial for anyone looking to make their money work harder for them.

At its core, compound interest is the process of earning interest on both the initial amount of money saved or invested (the principal) and the interest that has already been earned.

Unlike simple interest, which only earns you money on the principal, compound interest earns you “interest on interest.”

Imagine planting a tree. Initially, growth is slow, but as it matures, it sprouts new branches, which in turn grow and sprout more branches. Your money behaves similarly to compound interest. Over time, the amount of interest grows exponentially, not just linearly, because you’re earning interest on an ever-increasing amount.

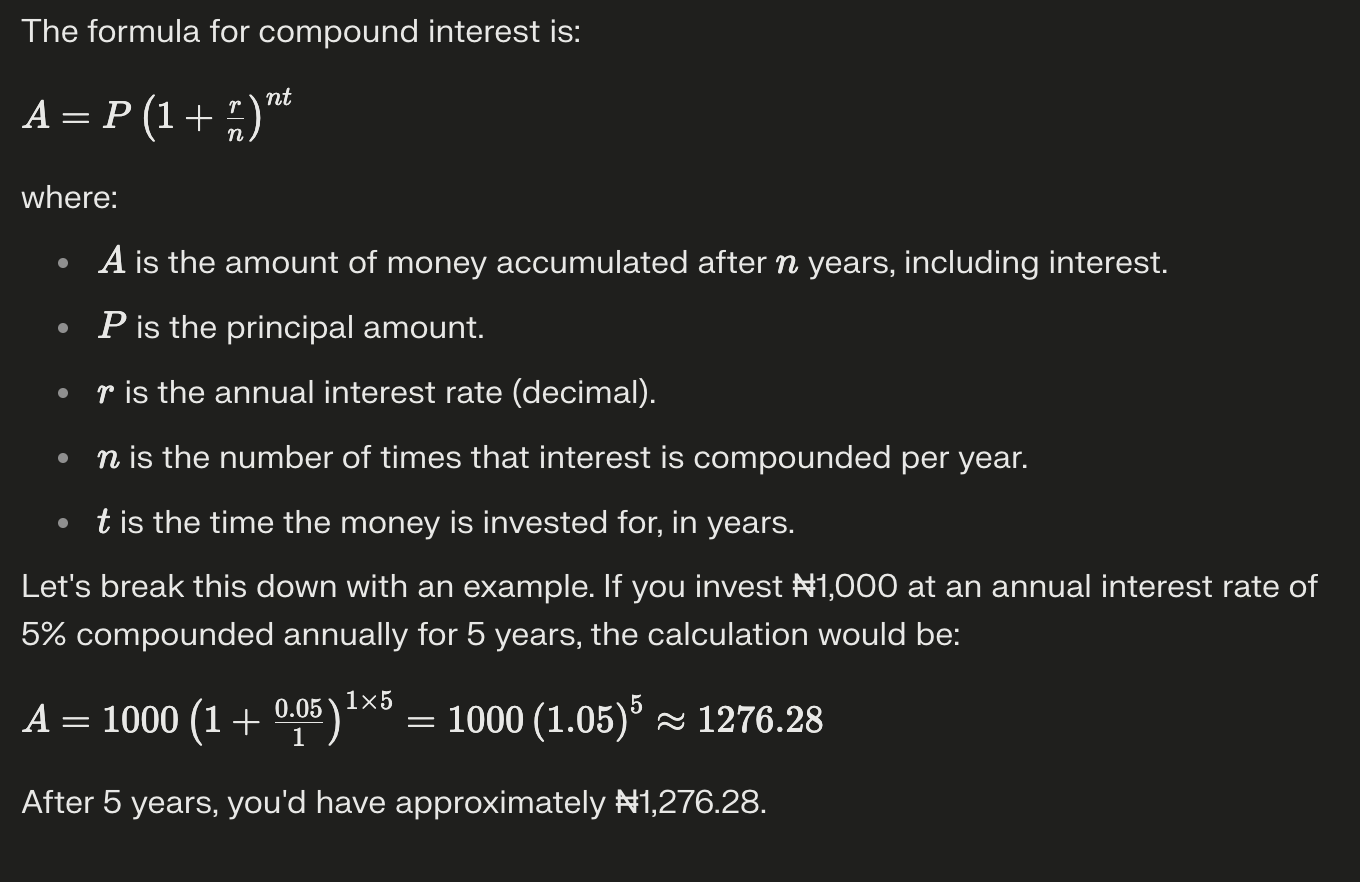

To fully grasp compound interest, you need to understand its components:

The frequency of compounding can have a significant impact on the total interest earned. Interest can be compounded on various schedules, from annually to daily. The more frequent the compounding, the more interest you will earn.

For investments, compound interest is the cornerstone of wealth building, allowing your assets to grow at an accelerated rate over time. Conversely, when it comes to loans, compound interest can significantly increase the amount you owe, making it essential to understand the terms of your borrowing.

While compound interest can significantly increase your savings, it’s not without risks.

Market volatility can affect returns, and inflation can erode the purchasing power of your interest. It’s also important to consider the impact of taxes on your compounded earnings.

Compound interest is a powerful financial concept that can help you build wealth or, if you’re not careful, contribute to growing debt. By understanding and applying this concept, you can make more informed decisions about saving, investing, and borrowing.

Remember, the key to maximizing compound interest is starting early, being consistent, and allowing time to work its magic on your finances.

As the P2P lending industry grows in Nigeria,...

Payday loans are a type of no-credit check...

Talking about money with your significant other might...